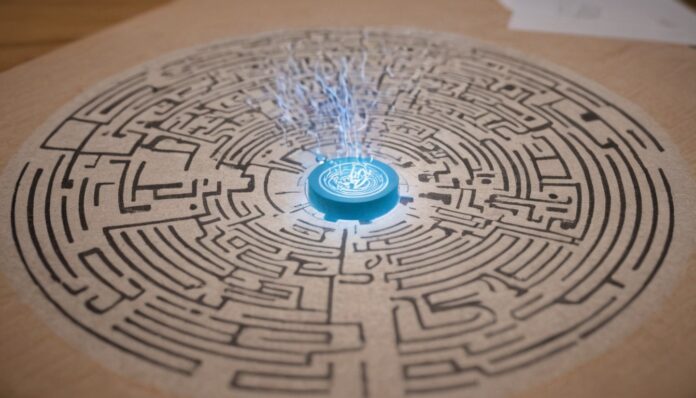

Otto Insurance: Navigating the Labyrinth of Quotes with AI-Powered Ease

In the ever-churning world of insurance, finding the right policy can feel like a lost quest through a labyrinth of confusing terms, hidden fees, and seemingly endless online forms. Enter Otto Insurance, a tech-savvy navigator aiming to illuminate your path with the guiding light of artificial intelligence. But before you click “Get Quote,” let’s delve deeper into what Otto does and how it might change your insurance game.

Beyond a Comparison Engine: Understanding Otto’s Core

While you might be tempted to categorize Otto as simply another insurance comparison website, there’s more to the story. Instead of merely throwing a mountain of quotes at you, Otto employs AI algorithms to understand your unique needs and risk profile. Think of it as a financial co-pilot, analyzing your driving habits, car type, location, and other relevant factors to recommend the most suitable policies from its vast network of trusted insurers.

This personalized approach extends beyond the initial quote. Otto’s AI companion, aptly named “OttoBot,” stays by your side throughout the journey, helping you navigate complex policy wording, understand coverage options, and even submit claims. It’s like having a friendly insurance expert in your pocket, ready to answer your questions day or night.

Benefits in Every Byte: What Otto Brings to the Table

So, what concrete advantages does Otto offer compared to traditional methods? Here are a few key highlights:

- Time-Saving Efficiency: Forget hours spent comparing quotes on different websites. Otto does the legwork for you, delivering tailored options in minutes.

- Personalized Precision: No more wading through irrelevant policies. Otto’s AI ensures you receive quotes that match your specific needs and budget.

- Confidence-Boosting Transparency: The platform lays bare policy details in clear, digestible language, empowering you to make informed decisions.

- Always-On Support: OttoBot stands guard, offering 24/7 assistance with any questions or concerns you might have.

- Potential Savings: By matching you with the right policies, Otto can unlock significant cost savings compared to generic online searches.

Beyond the Glow: A Balanced Perspective

Of course, no platform is perfect. While Otto’s AI-powered approach holds immense promise, it’s important to consider potential drawbacks:

- Limited Choice: Otto only partners with a select group of insurers, potentially excluding smaller companies with competitive offerings.

- AI Reliance: While helpful, AI algorithms can’t replace the nuance and expertise of a human insurance agent for complex cases.

- Data Privacy Concerns: Sharing personal information online is always a delicate dance. Ensure you understand how Otto uses and protects your data.

The Final Verdict: Is Otto Your Insurance Pathfinder?

Ultimately, whether Otto is your insurance soulmate depends on your individual needs and risk profile. If you’re looking for convenience, personalization, and AI-powered guidance, Otto offers a compelling proposition. However, if you value a wider range of choices or prefer the human touch, traditional methods might still be your preferred route.

The key takeaway? Do your research, understand Otto’s strengths and limitations, and see if it aligns with your insurance journey. Remember, choosing the right insurance is a marathon, not a sprint. Take your time, explore your options, and let Otto be one of the navigational tools guiding you towards a secure and protected future.